Reverse Mortgages Made Simple with Kenny King at Westridge Financial

Unlock the

Power of

Home Equity

Take control of your retirement and gain financial freedom by tapping into the equity you’ve already built in your home. Whether you're looking to supplement your income, pay off existing debts, or simply enjoy more financial breathing room—Kenny King is here to guide you through every step with transparency, trust, and a personalized approach.

Unlock The

Power of Your

Homes Equity

Take control of your retirement and gain financial freedom by tapping into the equity you’ve already built in your home. Whether you're looking to supplement your income, pay off existing debts, or simply enjoy more financial breathing room—Kenny King is here to guide you through every step with transparency, trust, and a personalized approach.

Why Choose Us

WE’RE TRANSPARENT

We believe honesty builds trust—and trust is everything when it comes to your home. That’s why we’re upfront about every part of the reverse mortgage process. No hidden fees, no confusing fine print. Just clear communication and complete clarity, so you can make informed decisions with confidence.

WE GUIDE YOU

A reverse mortgage can feel complex, but you don’t have to navigate it alone. We take the time to explain your options in plain language, answer every question, and walk with you step by step. From your first consultation to closing and beyond, you’ll have a trusted expert by your side.

BEST PRICE GUARANTEE

We’re committed to offering you the best possible deal—without sacrificing service. Our best price guarantee means if you find a better quote elsewhere, we’ll do everything we can to beat it. You get competitive rates, transparent terms, and the peace of mind that you’re getting real value.

Why Choose Us

WE’RE TRANSPARENT

We believe honesty builds trust—and trust is everything when it comes to your home. That’s why we’re upfront about every part of the reverse mortgage process. No hidden fees, no confusing fine print. Just clear communication and complete clarity, so you can make informed decisions with confidence.

WE GUIDE YOU

A reverse mortgage can feel complex, but you don’t have to navigate it alone. We take the time to explain your options in plain language, answer every question, and walk with you step by step. From your first consultation to closing and beyond, you’ll have a trusted expert by your side.

BEST PRICE GUARANTEE

We’re committed to offering you the best possible deal—without sacrificing service. Our best price guarantee means if you find a better quote elsewhere, we’ll do everything we can to beat it. You get competitive rates, transparent terms, and the peace of mind that you’re getting real value.

We’ll Help Find the Right Mortgage Solutions

Every homeowner’s situation is unique, and so are the options available to them. Whether you're looking to tap into your home equity, reduce monthly payments, or secure long-term financial peace of mind, we’re here to help you find the solution that fits

you best. We take the time to understand your goals, review your eligibility, and present mortgage options tailored to your needs—not just what’s easiest to sell. With expert guidance and a no-pressure approach, we’ll make sure you feel confident in your path forward.

We will help you find the best mortgage solution

Every homeowner’s situation is unique, and so are the options available to them. Whether you're looking to tap into your home equity, reduce monthly payments, or secure long-term financial peace of mind, we’re here to help you find the solution that fits you best. We take the time to understand your goals, review your eligibility, and present mortgage options tailored to your needs—not just what’s easiest to sell. With expert guidance and a no-pressure approach, we’ll make sure you feel confident in your path forward.

Estimate the cost

of your loan

Add Current Interest Rate Amount For Accuracy

Contact us to see how we can save

or grow your money

Contact us to see how we can save

or grow your money

Grow & Protect

Your Wealth in Retirement

Your home isn’t just where you live—it’s one of your most valuable assets. A reverse mortgage can help you unlock that value strategically, giving you access to funds while preserving your long-term financial health.

With the right approach, you can:

Supplement your retirement income

Cover medical expenses or unexpected costs

Avoid dipping into your investment or savings accounts too early

Provide financial support to family or loved ones

Grow & Protect

Your Wealth

Your home isn’t just where you live—it’s one of your most valuable assets. A reverse mortgage can help you unlock that value strategically, giving you access to funds while preserving your long-term financial health.

We’re here to help you use your home equity wisely—so you can enjoy today while still protecting tomorrow.

Supplement your retirement income

Cover medical expenses or unexpected costs

Avoid dipping into your investment or savings accounts too early

Provide financial support to family or loved ones

No Deposit Home Loan

Use a reverse mortgage to purchase a new primary residence. Ideal for downsizing or relocating, H4P lets you move without taking on a new monthly mortgage payment.

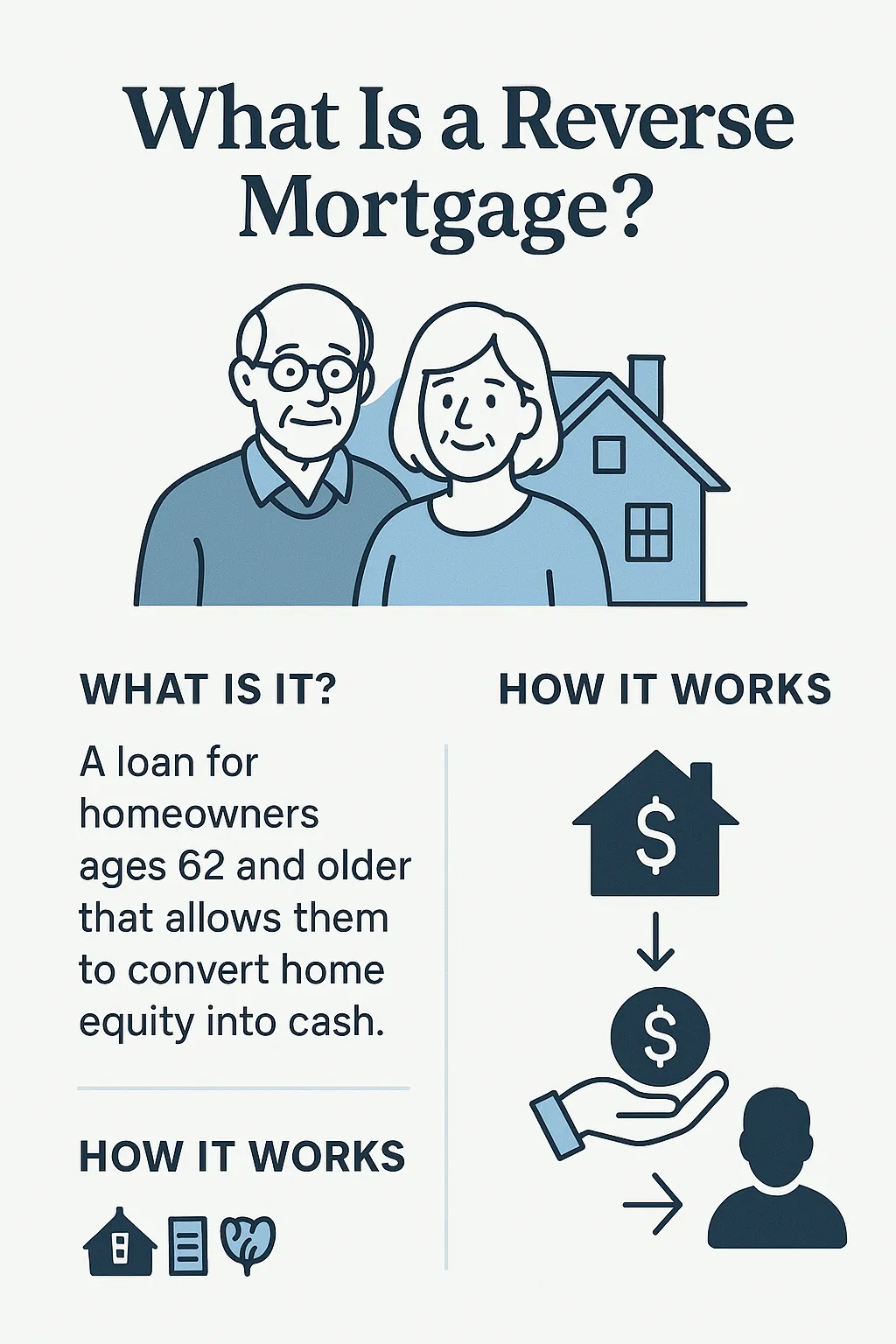

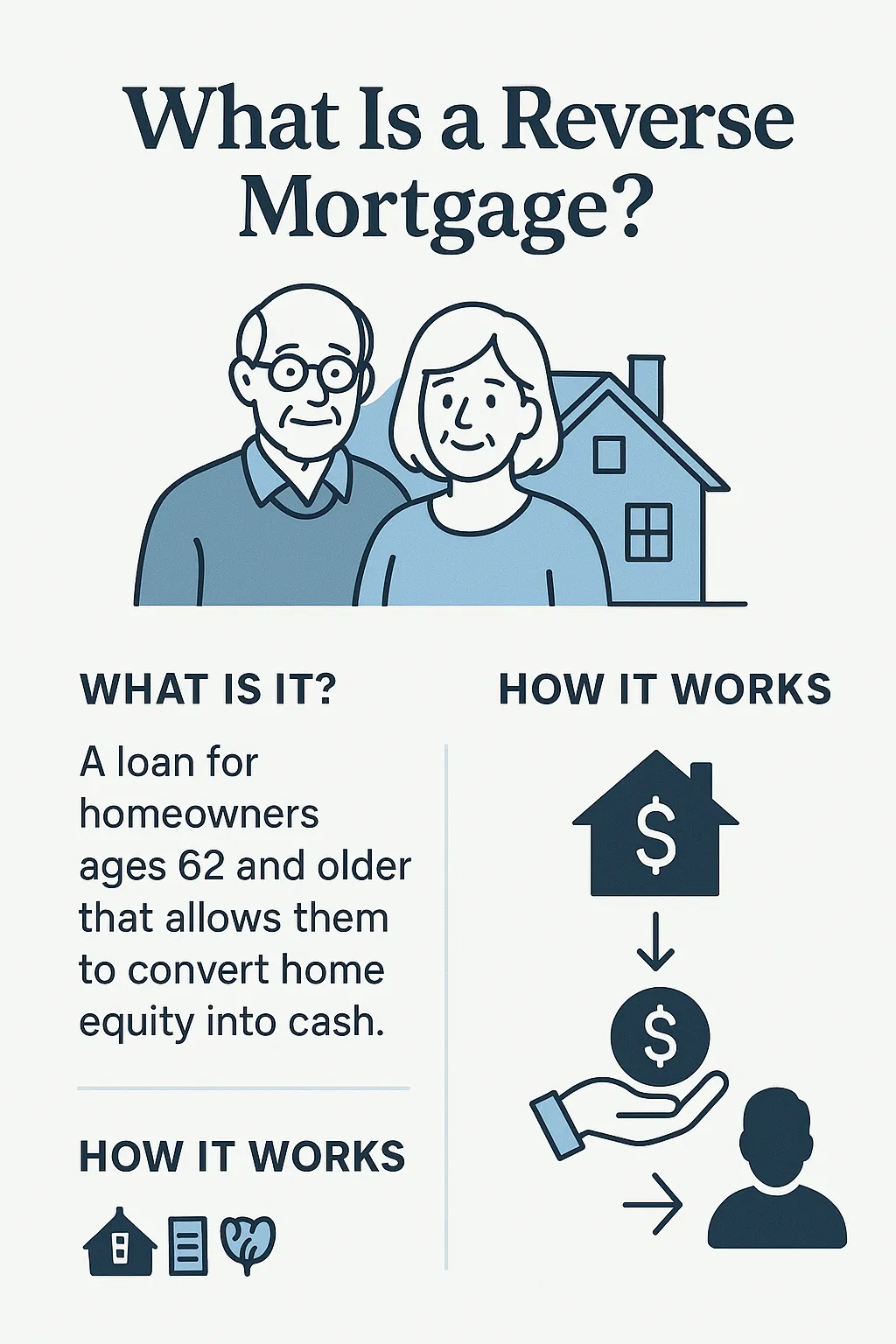

Reverse Mortgages

Designed for homeowners 62 and older, a reverse mortgage allows you to convert home equity into cash—without giving up ownership or making monthly mortgage payments.

Traditional Refinance

Lower your interest rate, reduce your monthly payment, or tap into equity with a conventional refinance—backed by trusted lending partners.

Home Equity Line of Credit (HELOC)

Access your home equity as a revolving line of credit. Draw funds as needed and only pay interest on what you use—perfect for flexibility and short-term goals.

FHA Loans

A government-backed option ideal for first-time homebuyers or those with less-than-perfect credit. Offers lower down payment options and competitive rates.

VA Loans

Exclusively for veterans, active-duty service members, and eligible spouses—VA loans offer no down payment, no PMI, and flexible approval terms.

Reverse Mortgages

Designed for homeowners 62 and older, a reverse mortgage allows you to convert home equity into cash—without giving up ownership or making monthly mortgage payments.

HECM for Purchase (H4P)

Use a reverse mortgage to purchase a new primary residence. Ideal for downsizing or relocating, H4P lets you move without taking on a new monthly mortgage payment.

Traditional Refinance

Lower your interest rate, reduce your monthly payment, or tap into equity with a conventional refinance—backed by trusted lending partners.

VA Loans

Exclusively for veterans, active-duty service members, and eligible spouses—VA loans offer no down payment, no PMI, and flexible approval terms.

FHA Loans

A government-backed option ideal for first-time homebuyers or those with less-than-perfect credit. Offers lower down payment options and competitive rates.

Home Equity Line of Credit (HELOC)

Access your home equity as a revolving line of credit. Draw funds as needed and only pay interest on what you use—perfect for flexibility and short-term goals.

Frequently Asked Question

What is a reverse mortgage?

A reverse mortgage allows homeowners 62 or older to convert part of their home equity into cash without having to sell the home or make monthly mortgage payments. The loan is repaid when the homeowner sells, moves out, or passes away.

Will I still own my home with a reverse mortgage?

Yes. You retain full ownership and remain on the title of your home. As long as you continue to live in the home as your primary residence, pay property taxes, homeowners insurance, and maintain the home, you stay in control.

How do I receive the funds from a reverse mortgage?

You can choose to receive your funds as a lump sum, monthly payments, a line of credit, or a combination—whichever fits your financial goals best.

Can I use a reverse mortgage to buy a new home?

Yes! With a HECM for Purchase (H4P), you can use a reverse mortgage to help buy a new home—often when downsizing or relocating—without the burden of a monthly mortgage payment.

What happens to my reverse mortgage when I pass away?

When the last borrower passes away or moves out, the loan becomes due. Your heirs can choose to repay the loan and keep the home, or sell the home and use the proceeds to pay off the balance. Any remaining equity belongs to your estate.

Contact Us To See How

We Can Save Or Grow

Your Money

Contact us to see how

we can save or grow

your money

Helping Utah homeowners make smart, confident financial decisions through personalized reverse mortgage solutions. Backed by Westridge Financial, Kenny King offers trusted guidance, transparent service, and competitive rates.

Quick Links

About Us

Services

Contact Us

Contact Us

801-891-4799

Kenny King – Reverse Mortgage Specialist | Westridge Financial – Utah

NMLS: 297668

Copyright 2025 . All rights reserved. Built by Impact Marketing Solutions.

Helping Utah homeowners make smart, confident financial decisions through personalized reverse mortgage solutions. Backed by Westridge Financial, Kenny King offers trusted guidance, transparent service, and competitive rates to help you unlock the value of your home and protect your future.